In the competitive banking sector, customer experience is now crucial for success. Net Promoter Score (NPS) and Lifetime Value (LTV) are key metrics assessing service quality and customer relationships’ long-term profitability.

The banking sector is experiencing changes worldwide due to crises, regulations, and digital disruption. To stand out from their peers, banks need to focus on providing better customer experiences—not just from a strategic perspective but, in some ways, as a matter of survival.

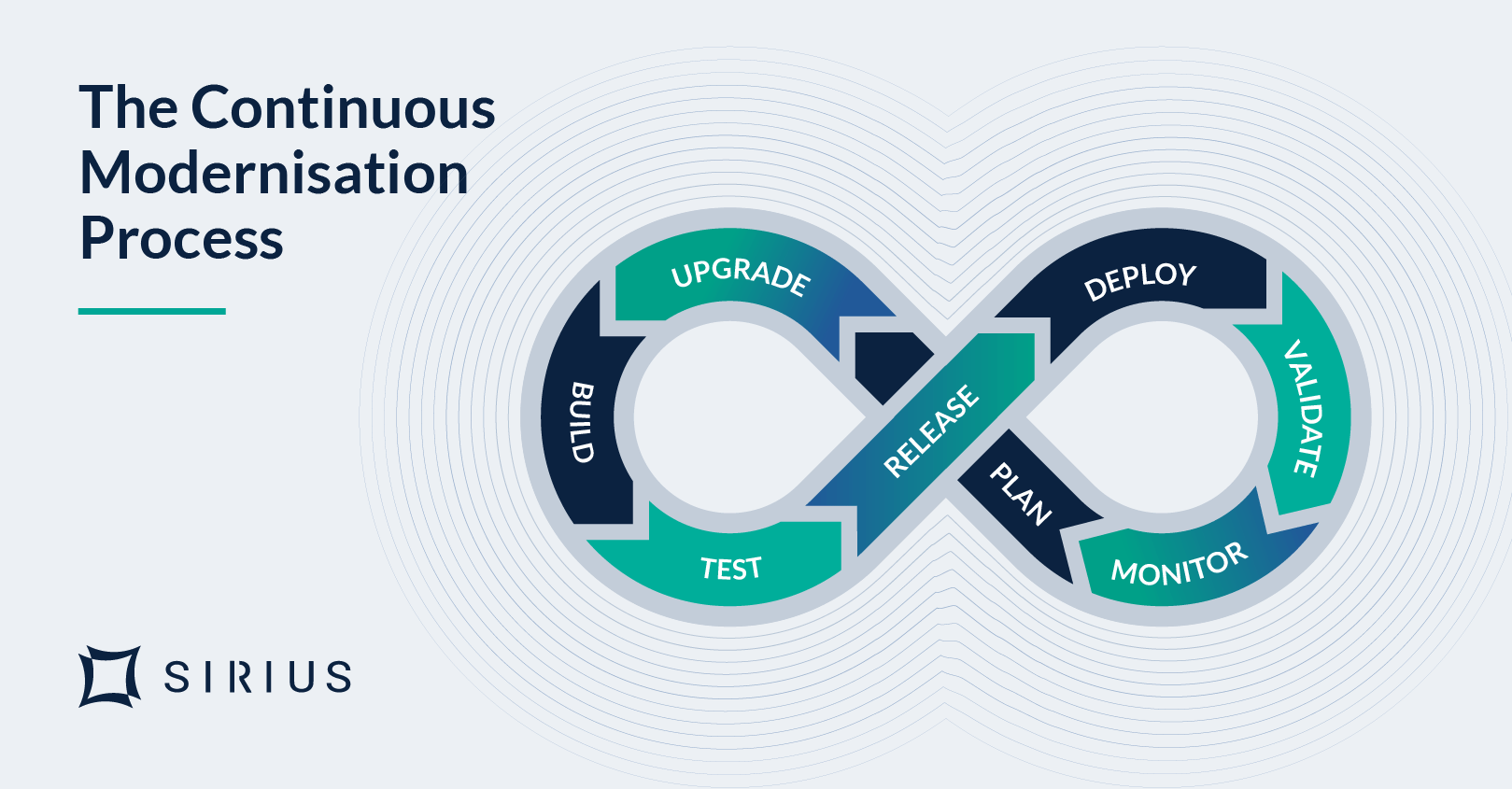

Continuous modernisation is a strategic approach that enables banks to evolve rapidly by responding to market changes. It offers far more than just operational efficiency—it helps create higher user engagement and more holistic business value.

Challenges Posed by Legacy Systems in Banks

Despite the urgent need for innovation, many banks are constrained by legacy systems that present many challenges. The combination of siloed back-end systems and legacy architecture impedes banks from facilitating outstanding customer experiences and quickly adapting to a rapidly evolving market.

- Limited Scalability: The rigidity and inflexibility of legacy systems make it harder for banks to scale their operations in order to increase to answer the demands of their customers. This limitation hinders a bank’s ability to roll out new services or scale out its existing ones, ultimately affecting growth and response to market shifts.

- High Risk: Legacy systems are prone to downtime and technical issues. These systems are often not as resilient or scaled as current technology and fail over time. Long downtimes jeopardise operational efficiency and stir up enormous customer dissatisfaction and financial losses.

- Lack of Innovation: Legacy systems are often not designed to support rapid innovation. Implementing new services or updating existing ones is frequently tedious and inefficient, preventing banks from keeping up with changing client expectations and technology improvements. This lack of progress usually puts these banks at a competitive disadvantage.

- Stagnating Customer Experience/Satisfaction: Limited scalability, high risk, and lack of innovation result in a stagnant customer experience. Customers today demand three things – fast, reliable, and personalised services. Given these crucial customer touchpoints, banks that rely on an older generation of platforms often fail to deliver, leaving customers less than fully satisfied and lacking in loyalty towards their institution.

Addressing these challenges through continuous modernisation is essential for banks to enhance their customer experience. Banks can improve their NPS and LTV by transitioning to modern technologies, ensuring long-term success in a rapidly evolving market.

How Modernisation Enhances Customer NPS and LTV

Continuous modernisation offers banks a path to overcome the limitations of legacy systems and significantly enhance both customer NPS and LTV. Here’s how:

Direct Benefits on NPS:

- Faster Service Delivery: Streamlined systems process transactions quicker and reduce wait time, improving overall service efficiency. This leads to higher customer satisfaction and better NPS scores.

- Personalisation of Financial Products: With extensive data analytics and expanded capabilities, current systems can provide customised financial solutions for each customer’s specific demands.

- Improved Reliability & Uptime: Modern platforms increase the availability and dependability of your services. Customers benefit from this stability as downtime and technical concerns are reduced.

Long-Term Impact on LTV:

- Upselling and Cross-Selling Opportunities: Continuously modernised systems provide banks with richer data insights to identify and act on upselling and cross-selling opportunities. Offering relevant products and services based on customer behaviour increases revenue and customer value.

- Increased Customer Retention: Satisfied customers are more likely to stay loyal to their bank. Continuous modernisation helps provide superior customer experiences, foster loyalty, and reduce churn rates, thereby increasing LTV.

By adopting continuous modernisation strategies, banks can significantly improve service delivery, personalise customer interactions, and ensure higher reliability. These improvements drive better NPS and LTV and position banks to thrive in an increasingly competitive and digital financial landscape.

Embracing Microservices for Real-Time Adaptability

A crucial part of continuous modernisation is the adoption of microservices. Microservices offer several key benefits that directly enhance customer experience and operational efficiency:

- Unlimited Scalability: Microservices enable banks to scale their operations effortlessly. Each service can be developed, deployed, and scaled independently, allowing for flexible and responsive growth. This scalability ensures that banks can meet increasing customer demands without major overhauls.

- Fail-Fast and Fail-Forward Approach: Microservices support a fail-fast and fail-forward approach, encouraging rapid identification and resolution of issues. This methodology creates a culture of endless innovation that enables banks to adopt changes rapidly. Fixing issues before they become widely known allows banks to realise greater quality of service and reliability.

- Enhanced Customer Experience: Microservices’ modular nature allows for real-time adaptability, ensuring that customer services are always responsive and up-to-date. This adaptability leads to a more personalised and efficient customer experience. Additionally, microservices enable seamless integration of new technologies, such as AI and advanced analytics, further enhancing customer service.

By embracing microservices, banks can achieve the agility and scalability needed to thrive in today’s dynamic market. This approach improves customer satisfaction and loyalty and continuously positions banks to innovate and adapt to future challenges.

Conclusion

Continuous modernisation is essential for banks and financial institutions to drive customer NPS and LTV. Banks that embrace modern technologies and methodologies can drive their service delivery to new heights and create more personalised customer interactions.

This strategic approach to better understanding the customer leads to increased customer happiness and loyalty, as well as putting the bank in the best possible position to innovate and navigate unknown challenges in the future.